For the last two years, we have been focused on charting the recovery from the COVID-19 recession. In short, the economy has rebounded at twice the speed of the previous four recessions. As the Omicron variant recedes nearly as quickly as it appeared, the economy is well into the growth period between the last recession and some future event. Setting aside the possibility of energy and price shocks from geopolitical events, history shows that this phase of an economic recovery brings a turn in consumer behavior as well.

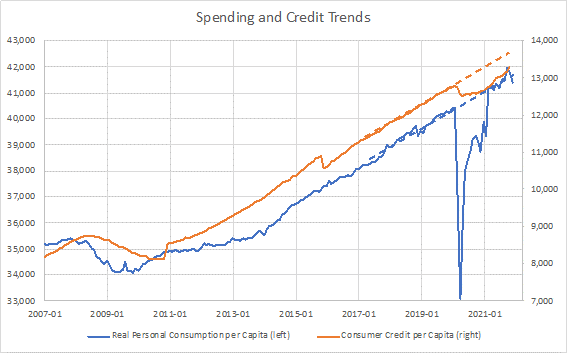

Figure 1 (included below) shows data from FRED, adjusted to per-capita measures. The lines show that spending has returned and exceeded the previous growth trendline. Note that the widely reported “drop” in spending in December 2021 was after seasonal adjustment. Spending did not drop. It failed to meet the expectations of the seasonal adjustments from previous decades. The same thing happened with reported employment levels for December 2021. The reported “drop” in employment was really a failure to meet seasonal expectations. In both cases, supply chain issues were more likely the root cause than any lack of desire to spend by consumers.

Figure 1 also shows that consumer credit is below trendline, but actually substantially higher than the level before the pandemic. Through a year when consumers could not spend, they paid down debt – but spending in 2021 erased those gains.

Back in 2009 – 2010, many financial news stories were written about consumers deleveraging by paying down credit cards and other debt during and immediately after the 2009 recession. Only five years later did consumer debt return to previous levels. What took five years before has now only taken one.

Tangentially, we could ask whether continued growth in consumer debt per capita is sustainable. The short answer is that no straight-line extrapolation is never sustainable. We just don’t know where the nonlinearities kick in. As for how consumer debt has grown from 2015 through 2019, the answer probably lies in low interest rates making debt more affordable, better data and models for improved loan targeting by lenders, and innovative new ways to provide consumers with the credit that they need.

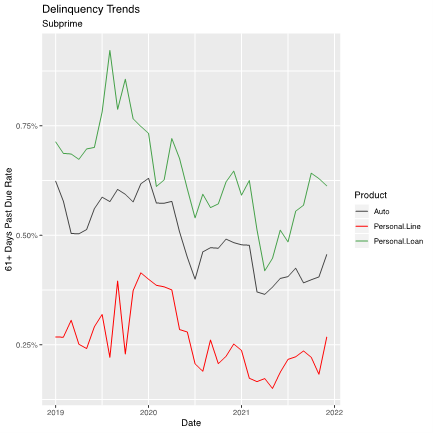

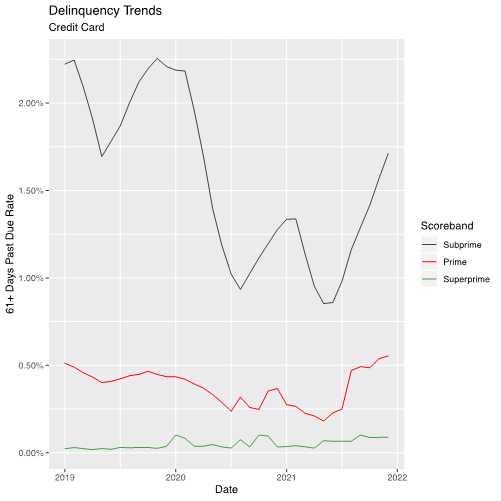

One of the biggest difficulties with economic data is the lack of timelines. Many indicators from government agencies are quarterly and significantly delayed. For that reason, the above graphs do not show government measures of consumer debt burden or retail loan delinquency trends. Instead, we are turning to the shared data pool maintained by Deep Future Analytics for its 250+ credit union and bank clients.

Figure 2, shown above, reveals mid-delinquency trends for auto, personal lines, and personal loans. For all three products, delinquency is well above the seasonal low in early 2021. Figure 3, below, illustrates the data for credit card, split by subprime, prime, and superprime. This illustrates well what we also saw in other consumer products. Subprime delinquency is rising fastest, returning to 2019 levels in some cases. whereas prime and superprime are rising, though more slowly. Naturally, auto delinquency is rising the least for prime borrowers due to the fact used cars are in such high demand. Distress auto loan borrowers have options.

Mortgage trends were not considered in this analysis, because they are strongly impacted by forbearance policies and not particularly informative at this time.

This analysis was begun in response to a recent two-part question: “Has the credit cycle turned? Do we have a problem?”

The answer? Yes … and no.

Even adjusting for seasonality, the best period of the credit cycle in 2021 is behind us. No more government pandemic assistance is coming and consumers who have become accustomed to a certain amount of debt payments are spending until they return to previous norms. This is especially true of subprime consumers. Even with high job availability, rising debt levels will translate to increased delinquency as consumers must adapt to their new cash flow realities.

However, this is not a crisis. DFA has been reluctant to use 2020 – 2021 loan performance data in our credit risk models as they do not reflect normal consumer behavior. We always assumed consumer behavior would return to 2015 – 2019 dynamics and have recommended that lenders price as if that is the future. As long as lenders are not pricing future loans for the near complete lack of charge-offs seen in 2020 – 2021, there is no credit cycle crisis.

The credit cycle is not a cycle like the seasons or sunspots. Consumer behavior and the economy are never static, but they also do not observe a fixed periodicity. Everything through the pandemic has felt compressed, compared to recent cycles. Therefore, we will continue to keep close watch on these credit trends, because the next phase of the credit cycle could come quicker than we are all accustomed to.

About the author - Dr. Joseph L. Breeden, CEO, Prescient Models LLC, has been designing and deploying risk management systems for loan portfolios since 1996. He is the founder of Deep Future Analytics, which focuses on portfolio and loan-level forecasting solutions for pricing, account management, stress testing, and CECL and serves credit unions, banks, and finance companies. He is a member of the board of directors of Upgrade, a San Francisco-based FinTech; an Associate Editor for the Journal of Credit Risk, the Journal of Risk Model Validation, and the Journal of Risk and Financial Management; and President of the Model Risk Managers’ International Association (mrmia.org). His most recent books, Living with CECL: Mortgage Modeling Alternatives and Living with CECL: The Modeling Dictionary were published in 2018.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer