On September 21, 2022, the Federal Open Market Committee (FOMC) increased the federal funds rate by 0.75% to help achieve its objective of maximum employment and controlled long-term inflation at 2%.

The FOMC is a committee of Federal Reserve Bank governors and presidents that set monetary policy within the U.S. economy. The federal funds rate increases are a result of inflationary pressure experienced over this past year.

Below is an in-depth overview of some of the historical items that led to our current experience, combined with prognostication of what might happen because of current experiences and changes to take into consideration when evaluating your portfolio performance metrics.

It’s hard to believe it’s been nearly 15 years since we experienced the financial crisis of 2008. After missteps within the financial services industry and the devaluation of mortgage-backed securities, financial institutions were faced with difficult challenges and burdened with losses leading to dangerously low capital ratios. As a result, several financial institutions did not survive.

Furthermore, the Federal Reserve Bank setup strategies that kept the economy from catastrophic economic damage by creating a mechanism for financial institutions to borrow money at 0%. Over the course of the next 10 years, the Federal Reserve Bank participated in what’s known as Quantitative Easing. This allowed the Federal Reserve to purchase financial assets and lend cash to financial institutions at low interest rates (0%) to promote economic growth.

Since financial institutions were allowed to borrow money for free (cost of funds = 0%), they were able to lend money at low rates which incentivized accountholders to incur debt, for example, through auto loans, personal loans, and mortgage loans.

Around the same time, the Federal Reserve Bank was ending its Quantitative Easing (or acquisition of financial assets), the COVID pandemic occurred, causing a significant macroeconomic challenge due to a combination of events: (1) supply chain challenges due to shipping disruption and (2) government stimulus money provided to all U.S. households meeting an established income requirement. The increase in household money combined with a decrease in products to buy led to significant price in-equilibrium. Because of this, inflation began to increase as consumers were willing to purchase goods for prices that were elevated far above price equilibrium due to demand exceeding supply.

This invasion coupled with the COVID pandemic price in-equilibrium and the increase in the cost of fuel created a significant product price inflation that has exceeded 8% for the last six months (consecutively).

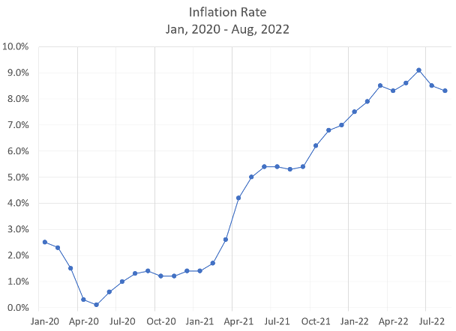

Within Chart 1, you’ll see inflation began to increase steadily and very significantly beginning in March 2021.

Chart 1: Inflation 2020 - 2022

Source: Bureau of Labor Statistics

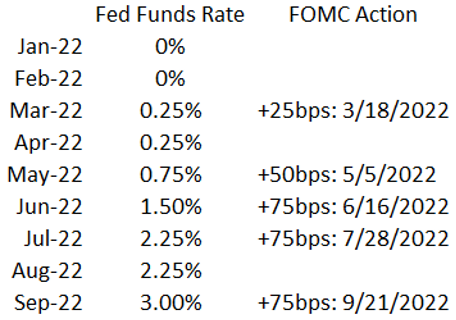

To protect the value of the dollar, the Federal Reserve was forced to respond to inflation. The primary objective of the Federal Open Market Committee is to stabilize prices (manage inflation) while maintaining sustainable economic growth. Over the course of a few months, the Federal Reserve increased the Federal Funds Rate five times at each of the last five FOMC meetings (see Chart 2).

Chart 2: 2022 Fed Funds Rate Adjustments

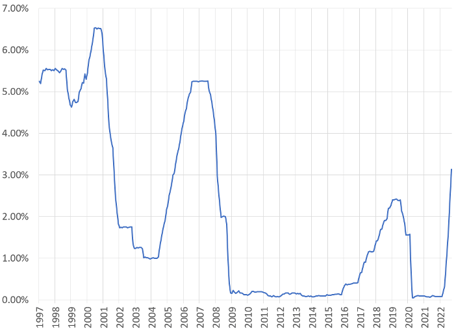

The changes over the past six months are steeper than experienced over the previous three Fed Funds Rate increases during the last 25 years. (See Chart 3)

During the 2016 – 2019 increases, a stair step trend appears with Fed Funds Rate increases that enabled the committee to periodically assess the economic impacts of these changes. While these changes are dramatic and apparent, especially to the consumers who borrow using rates that are tied to the prime rate, the current Federal Funds Rate is still the lowest level it’s been since the financial crisis of 2008.

Chart 3: Fed Funds Rate Adjustments, 1997 - 2022

Source: Federal Reserve Economic Data (FRED)

The inflation and interest rates battle is impactful – and the rationale for aggressively combating inflation relates to the value of “$100,000” in savings (or “$1,000,000” or “$100”).

The amount of goods that can be purchased with a given dollar amount today has significantly decreased in value, as this same dollar affords purchases of typically fewer goods due to inflation.

With this being said, the protection of savings is important. Without protection of the value of savings, the value of “goods” is more meaningful than the value of “money.” The Federal Reserve Bank is responsible for managing inflation and does so by providing incentives to save and disincentivizes people to spend or borrow money using the Federal Funds Reserve lever.

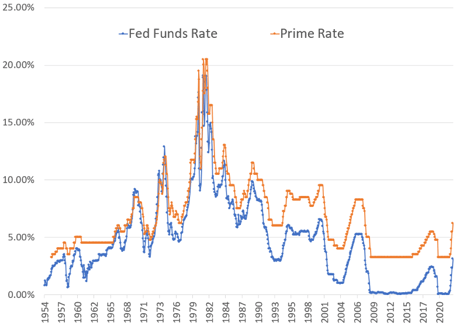

Most credit card balances are tied to the Prime Rate. The Prime Rate is the rate financial institutions charge for their prime customers. Previously, the focus was on the cost of money as it relates to the “Federal Funds Rate”. However, the official Prime Rate definition is the rate posted by a majority of the top 25 insured U.S.-chartered commercial financial institutions. The practical definition of the Prime Rate is the Federal Funds Rate + 3.00%. This correlation between the Federal Funds Rate and the Prime Rate has held true since 1993. (See Chart 4)

Chart 4: Prime Rate & Federal Funds Rate, 1954 - 2022

Source: Federal Reserve Economic Data (FRED)

A Prime Rate increase causes an increase to the cardholder's cost of items that were purchased “years ago.” With an increase of 3.00% APR in interest rates (as of September 2022), an average cardholder with a credit card balance of $6,200 would have an increased minimum payment due of $15.50 per month. Because of that increased burden, there’s also an increase to the risk for the cardholders and the financial institutions for increased delinquency and charge-offs based on the potential inability to pay debt.

With continued Federal Funds Rate and Prime Rate increases anticipated in the next three or four months, the same cardholders would have their minimum payment fuel increase another $5.00 on average.

Financial Institutions must pay more for deposits (via Federal Reserve or via existing accountholder deposits). For revolving credit cardholders, the increase in interest revenue is offset by the increase in interest costs to borrow funds. For transactor credit cardholders (cardholders who do not pay interest), the increased cost of funds directly impacts the profitability of those cardholders.

Over the past 14 years, the cost of funds for financial institutions has been virtually 0%, which in part has led to significant changes in how financial institutions promote transactors through rewards programs. An increase in cost of funds will shift the profitability of rewards programs. As a result, financial institutions need to investigate re-modeling the value of rewards programs as well as the implications of existing promotion of rewards programs.

Financial institutions should spend more time navigating portfolio performance metrics specific to delinquency trends, delinquency roll rates, payment ratios, and collection efficiency. Prime rate increase and the increased cost to buy goods have triggered an increase in cardholder strain – which may be recognizable within the data via a slow increase in ratios.

By monitoring the ratios and managing the performance portfolio metrics, financial institutions can protect themselves from potential credit risk of losses. Additionally, the CECIL calculations should factor into the subjective nature of losses not quantifiable within the existing reports and metrics but still anticipated based on the known challenges for cardholders.

Households that don’t currently have a credit card with a financial institution might be struggling and fearful of the implications caused by interest rates and inflation, prime rate increase, and federal funds rate increases. This fear may lead to applications for credit cards with financial institutions.

The FICO score may also reveal high quality and may not have fully refactored the potential risk of the applicant. Financial institutions should consider their underwriting strategies and the weight within the underwriting scorecard for items such as: (1) debt to income ratio, (2) length of credit history, (3) length of employment, and (4) number of recent inquiries.

By reconsidering the underwriting filter to address those who are hungry for credit during this phase of economic challenge, your financial institutions can help protect the quality of your portfolio performance metrics. In addition, financial institutions should consider doing more vintage reporting to confirm the quality of the monthly underwriting.

The impacts of higher interest rates and inflation impact people differently depending on a variety of circumstances. Households with lower and fixed income, younger individuals, and those with higher credit card debt will struggle with increased rates, while other households that aren’t as negatively impacted may get by through modified consumer behavior (buy less, save more).

Those who aren’t as negatively impacted might stop using their credit cards to capitalize on the equities market and/or purchase more “investment” style items, as opposed to consumption items on credit cards. Likewise, the lower-risk cardholders that have cash may wait until the last moment to make their payments in full – capitalizing on the grace periods offered.

These changes in consumer behavior have caused a significant shift in portfolio performance metrics. And while an institution’s portfolio may consist of the same accountholders, the behavior and performance of the portfolio itself are likely far different than what it once was prior to the inflation and increased interest rates.

The goal should be to consider the secondary and tertiary implications based on primary observations. The intent would be to consider the implications that might occur soon, and in a manner that will help to best manage a credit card portfolio. Ultimately, though, the intent is to factor in risks not yet clear and present.

The tertiary implications of inflation and rising interest rates may have to be considered as the risk of recession, the risk of future decreasing rates, or the implications of new products within the industry such as Buy Now Pay Later (BNPL).

If the United States enters a recessionary period, a financial institution should strongly consider the implications listed above before any negative impacts on the portfolio. A few simple changes in management practices now could significantly help your financial institution further down the road.

We encourage financial institutions, accountholders, and cardholders to take a moment and review this information. Our hope is it helps you better navigate the challenges of managing your portfolio performance metrics in an everchanging economy.

Without all the answers available, the challenge is asking the right questions that will lead to the identification of information best suited for each individual and financial institution.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer