What’s driving financial institutions forward in 2025?

In the years following the pandemic, banks and credit unions have invested heavily in digital transformation. Now, in 2025, the focus has shifted from building new systems to maximizing the value of existing technology and talent.

Efficiency is no longer just a goal – it’s a strategic imperative.

According to our seventh annual Jack Henry™ Strategy Benchmark, which highlights the top strategic priorities for forward-thinking bank and credit union CEOs, the most critical areas for 2025 and 2026 include improving efficiency, driving deposit and loan growth, acquiring new accountholders, and expanding solutions for small and medium-sized businesses (SMB).

These priorities reflect a sharpened focus on sustainable growth, competitive differentiation, and deeper engagement across all segments.

Winning Growth Without Growing Costs

In 2024, growing non-interest expenses and provision expenses drove declines in annual net income and ROA for both banks and credit unions.

With today’s tariffs and trade wars creating significant economic uncertainty, how can banks grow deposits – their top strategy priority, and how can credit unions grow loans and membership – their second and third top priorities?

Your data is key to:

- Discovering hidden SMBs and capturing their deposits

- Acquiring Gen Z with faster, smarter know-your-customer (KYC) at account opening

- Delivering service, trust, and relationship building at scale with the same people, data, and technology you’ve invested in

Data-Driven, People-First Banking

To capture Gen Z and Gen Alpha accountholders, you must embrace an open banking infrastructure that enables streamlined KYC and mobile-only account openings in under three minutes.

At the same time, your data and analytics capabilities are crucial to uncovering camouflaged SMB owners hidden in retail checking accounts. By leveraging core data, you can deliver personalized offers and automate instant approvals for SMBs looking to accept payments deposited directly into your financial institution – unlocking new revenue streams and deepening relationships.

To stay competitive, applying data-driven automation across business lines to enhance operational efficiency is just as important.

Leveraging AI and AI-assist to dramatically improve both the speed and quality of personal service and engagement will be table-stakes. Doing more (and doing it better) with the same resources is how you’ll not only improve efficiency, but also drive growth in deposits, loans, accountholders, and margins.

Top Insights From the 2025 Strategy Benchmark

This year’s findings highlight not only what’s top of mind for financial institution CEOs, but also how they’re adapting to economic uncertainty, shifting consumer expectations, and the accelerating pace of innovation.

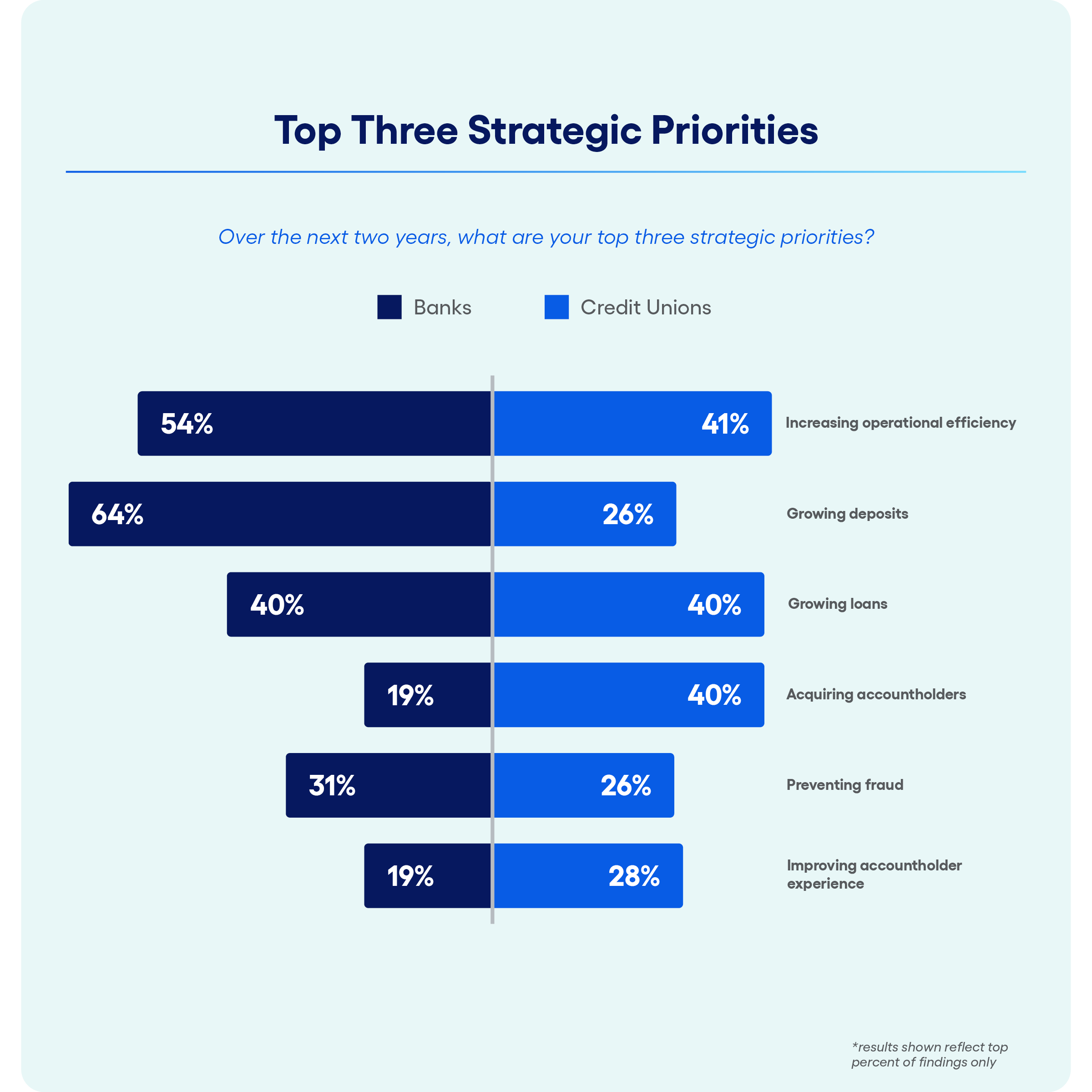

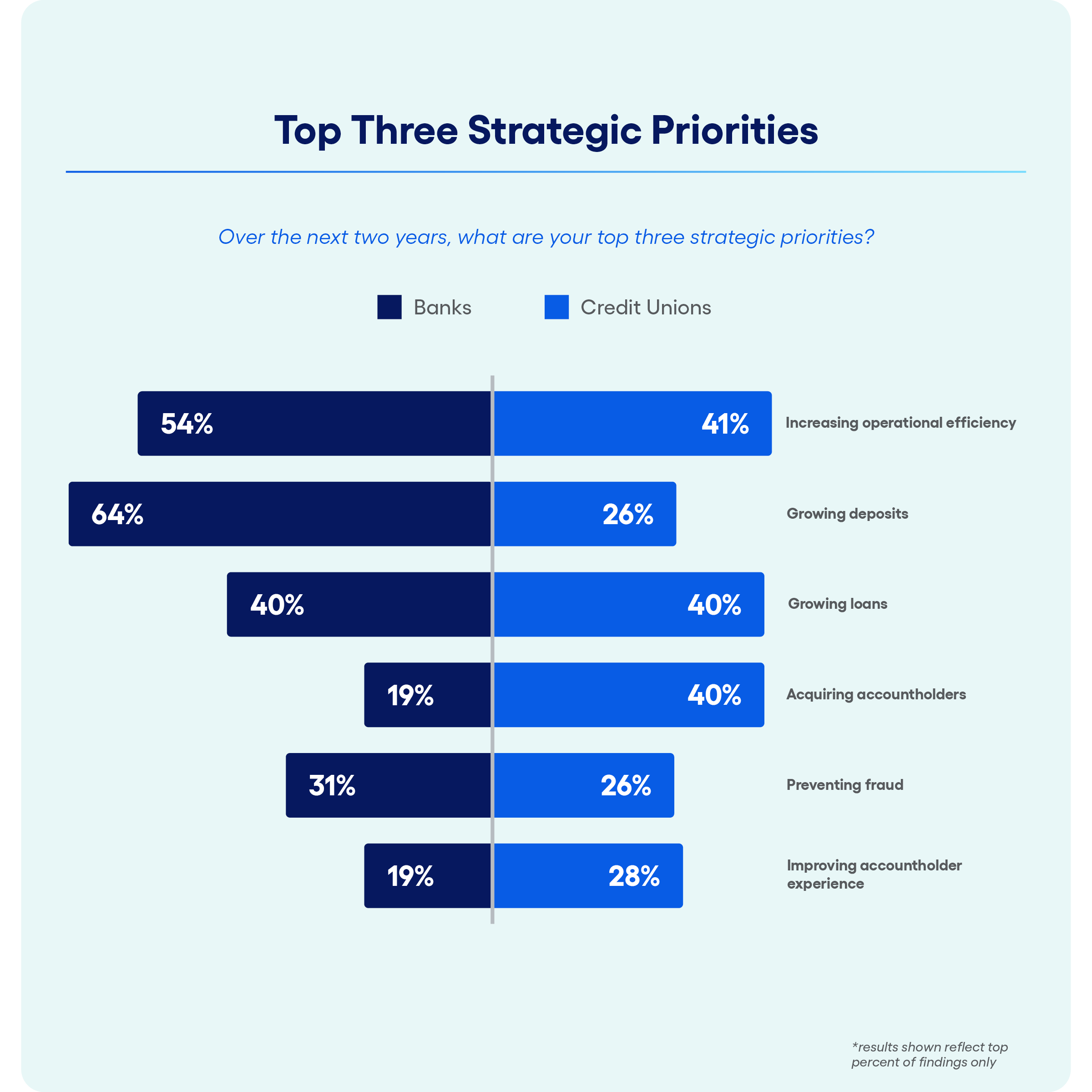

- 54% of bank CEOs and 41% of credit union CEOs named efficiency as a top strategic priority – making this the first year efficiency has taken the top spot across total respondents.

- While growing deposits remains the top strategic priority for banks (64%), credit unions (40%) have shifted focus to growing loans.

- 76% of all financial institutions plan to increase technology spend this year and next, down slightly from 80% last year. Credit unions are significantly more bullish on budgets with 47% planning to increase tech investments between 6% and 10%, compared to only 16% of banks, with most banks (43%) planning to increase their tech investments between 1% and 5%.

- While digital banking, fraud prevention, and automation are the top three technology investments planned over the next two years, more banks are increasing their spend on cybersecurity and AI. Though credit unions have historically given outsized priority to AI investments relative to banks, the number of banks (24%) reporting AI investments grew by double digits year-over-year.

- Fraud losses and cyberattacks are fast-growing concerns for both banks and credit unions – ranking as the top concern among respondents in aggregate (38%) for the first time, with concerns about net interest margin (NIM) compression falling to second (34%) and deposit attrition/displacement tied with cyberattacks for third. Banks remain concerned about talent acquisition/retention (36%) while credit unions continue to harbor outsized worry about acquiring younger accountholders (37%).

- For banks, NIM remains the key performance metric for 2025 and 2026 (64%), while credit unions plan to focus on return on assets (ROA) and accountholder growth/attrition (58%). As a greater proportion of credit unions experienced improvement in their NIM last year, their concerns about NIM compression this year declined by double digits.

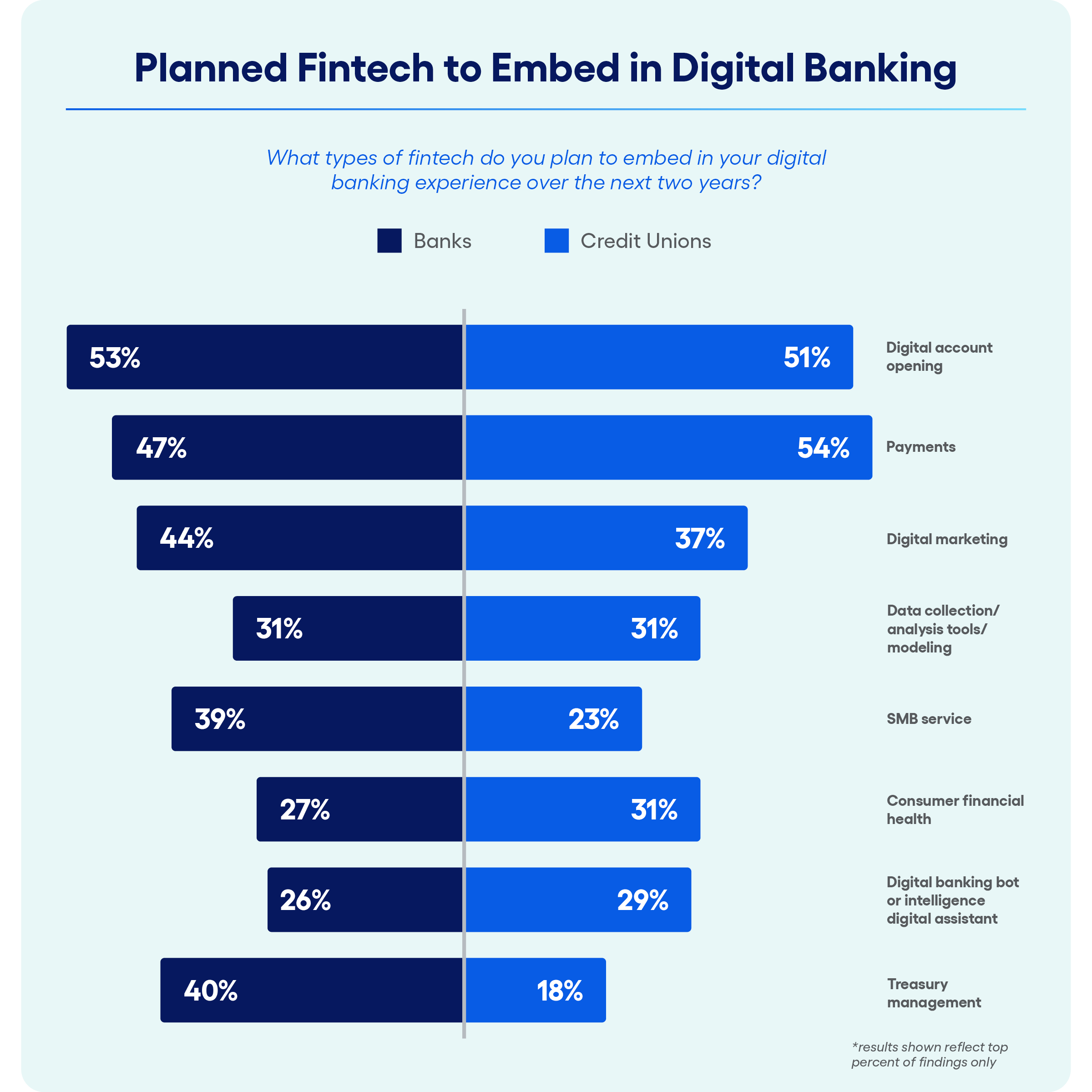

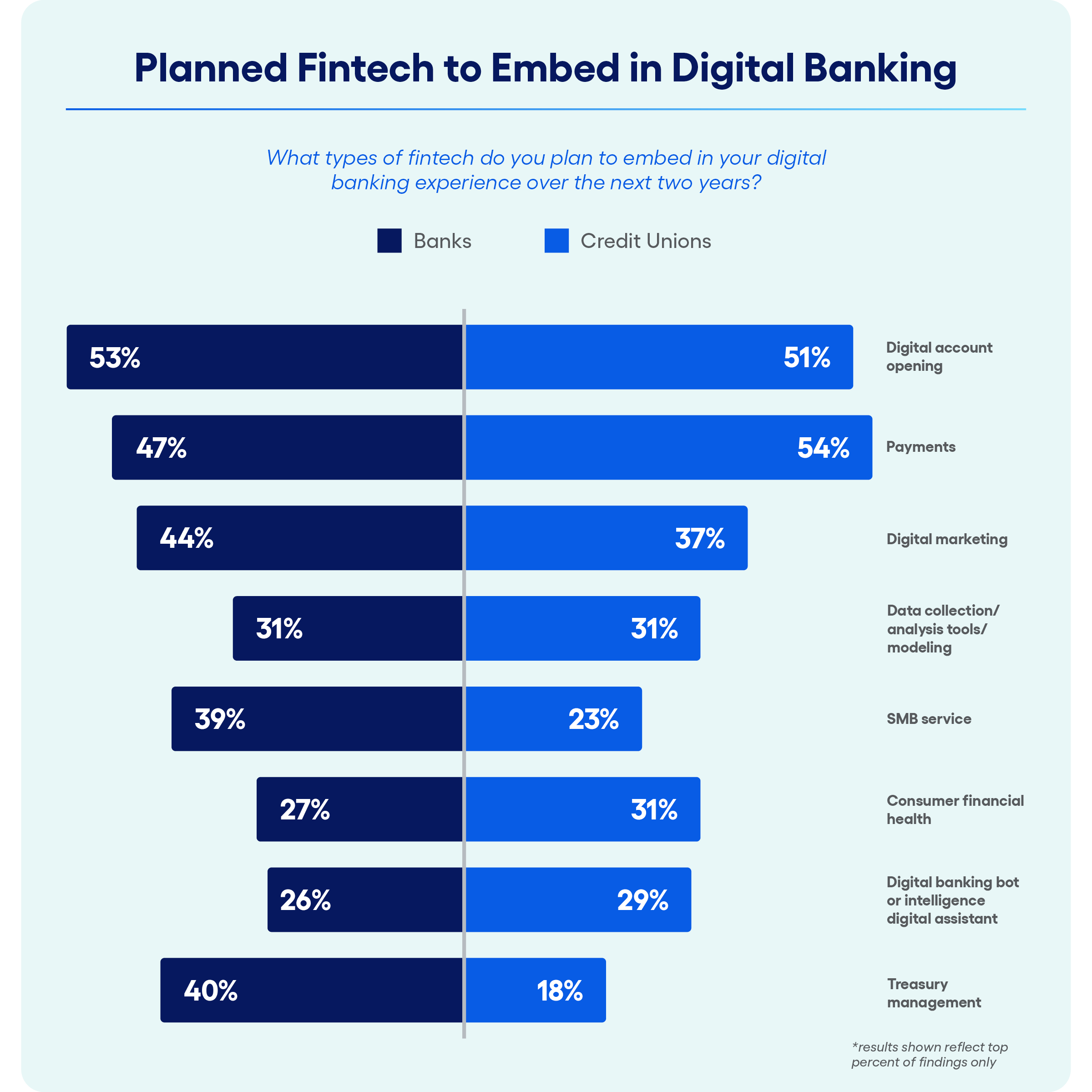

- Almost all financial institutions (94%) plan to embed fintech into their digital banking experiences with a slight majority (52%) planning to embed digital account opening (DAO) followed by payments (51%). Credit unions are also looking to embed consumer financial health and digital marketing fintech while banks are looking to fintechs for help with small business services and treasury management.

- 80% of banks and credit unions plan to expand services for small businesses – up from 78% in 2024 and 65% in 2023, with plans to add payment services, digital service tools, and credit/lending options for their small business accountholders over the next two years.

- 89% of financial institutions plan to add new payment services within the next two years, with FedNow® Service being the top priority for both banks and credit unions. Digital card issuance, same-day ACH, and contactless cards round out the top payment priorities for 2025 and 2026.

- Majority of financial institutions (90%) plan to enhance their lending capabilities, but priorities diverge sharply and predictably between banks and credit unions – with banks prioritizing automated workflow, automated financial spreading, and portfolio credit monitoring and credit unions focusing on underwriting using AI, rules/decision engines, and automated funding.

- When asked which fraud threats concern them most, CEOs cite account takeover (ATO) fraud, authorized push payment (APP) fraud/scams, and forged or counterfeit check fraud as their top concerns.

- Both banks and credit unions report phishing attacks as their biggest cybersecurity threat over the next two years, with ransomware and malware rounding out the top three threats.

Ready to Do More With Less?

As you reflect on the priorities revealed in the 2025 Strategy Benchmark, one thing is clear: you have a real opportunity to do more with less by putting data at the center of your strategy.

Whether you're just beginning or refining your approach, focus on what will move the needle: invest in open banking to build a more agile infrastructure, accurately identify small business owners to better serve a vital segment, and focus on staying ahead in a rapidly evolving financial landscape.

With the right insights, you can build a strategy that’s not only efficient but built to last.

Take your strategic planning to the next level! Download the Strategy Benchmark to explore the full findings and discover how to shape a competitive strategy that helps you not only compete – but win

.svg)