The proliferation of financial data exchange in the U.S. has made it easier for consumers to share their account information with a wide array of providers. Even before rates began to rise in 2022, deposits held at community financial institutions were being steadily siphoned by a long list of new competitors and disruptors.

The challenge doesn’t end with deposits:

In fact, today’s average consumer has 20-30 financial accounts, while millennial families regularly maintain 30-40 financial relationships. Those relationships, often managed digitally, lead to an average of 14 financial services apps on smartphones in the U.S.

This financial fragmentation makes it difficult to know where a given consumer stands with his or her money. Without that understanding, it’s almost impossible for the consumer – or their financial institution – to know what to do next or how to do better.

Combined with inflation and the cost-of-living crisis many Americans are experiencing, financial fragmentation contributed to a decline in financial health in 2022 – the first decline of its kind in the last five years. According to the Financial Health Network, only 31% of individuals are now considered financially healthy, leaving nearly 70% of Americans to struggle.

As serious as the situation is, there are concrete steps banks and credit unions can take to improve crucial financial health support – by enabling accountholders to gain control over their financial data and position. These include:

While some banks and credit unions set out to accomplish this by developing their own relationships with individual fintech data aggregators, it’s a much easier task when performed at scale and delivered through a digital banking platform provider.

For example, Jack Henry™ established integration agreements with the four largest data aggregators – Mastercard’s Finicity, Plaid, Akoya, and Envestnet | Yodlee – to bring secure data exchange to the Banno Digital Platform™. Integrations like these leverage secure, open APIs to effectively eliminate the security risks and poor user experiences that occur when financial data is shared through screen scraping while bringing additional visibility and control to the accountholder.

To become the hub of their accountholders’ financial lives, banks and credit unions need to provide a 360-degree view of all financial accounts and activities. This only becomes possible when external accounts can be aggregated into the digital banking experience.

This aggregation of external accounts has been technically possible for many years, offered through various personal financial management (PFM) tools. But it never reached mainstream adoption with community or regional financial institutions because the business model for bi-directional aggregation was broken.

When charged a fee for each account aggregated by an accountholder each month, financial institutions were disincentivized to offer or promote the service. It became too expensive too quickly and essentially died on the vine.

Until now.

By expanding the relationship with Finicity and pioneering a pricing model that makes account aggregation affordable, Jack Henry banks and credit unions can today offer external account aggregation within the digital banking platform.

This ability to offer accountholders a 360-degree view of their finances from a single app – theirs – provides banks and credit unions the ability to reclaim their position at the center of their accountholders’ financial lives while simultaneously tackling the negative financial health consequences of financial fragmentation.

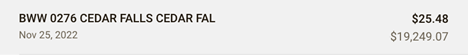

Credit or debit transaction statement descriptions can confound nearly anyone. The lengthy alphanumeric strings that contain bits of a company’s name, location, store ID, or reference code are inconsistently applied by merchants and processors, making it difficult to understand where money is being spent.

That lack of clarity creates a barrier toward empowering financial health, stymying efforts to categorize transactions or create actionable insights. An agreement with Mastercard™ to utilize their Places API to enrich transaction descriptions brings new visibility to Jack Henry’s digital banking users.

Making this:

Into this:

Providing enhanced clarity gives accountholders the information they need to understand and categorize their spending. This, in turn, creates the foundation for developing actionable insights to inform the behavioral changes that can improve accountholder financial health.

The power of transaction enrichment gets multiplied exponentially when applied to the aggregation of external accounts within the digital banking experience. Beyond the obvious financial health benefits to consumers, financial institutions will gain easily digestible, clean data about their accountholders’ entire financial lives.

At that point, banks and credit unions can decide whether – or how – to use that information to inform strategic or tactical plans to expand share of wallet and compete effectively inside the crowded financial services landscape.

Often used as a third-party app or accessed through a single sign-on (SSO), personal financial management tools have traditionally been relegated to the lowest tiers of digital banking. Mass adoption of PFM has struggled accordingly.

The ability to deliver external account aggregation and enriched transaction descriptions within the digital banking experience marks a fundamental change. Rather than PFM capabilities provided as a distinct service, financial data, and insights can – and should – become an embedded part of the digital banking experience.

Successful banks and credit unions will provide categorized transactions and spending, external account access, and more within the digital banking framework. Providing accountholders with these data points and insights from the app they already use regularly can bring banks and credit unions to the center of their accountholders’ financial lives.

Financial health support and addressing financial fragmentation cannot be an afterthought for banks and credit unions interested in thriving in today’s financial environment. Taking these four concrete steps in 2023 can help kickstart the development of a comprehensive financial health strategy, and position banks and credit unions for long-term success.

Stay up to date with the latest people-inspired innovation at Jack Henry.

.svg)

Learn more about people-inspired innovation at Jack Henry.

Who We Serve

What We Offer